“History never repeats itself, but it does often rhyme.”

– Mark Twain

This piece focuses solely on past bitcoin price action and is no indication of any thesis, future predictions, nor financial advice. There were many similarities between the infamous 2013 and 2017 bitcoin bubbles, both in magnitude and timeframes.

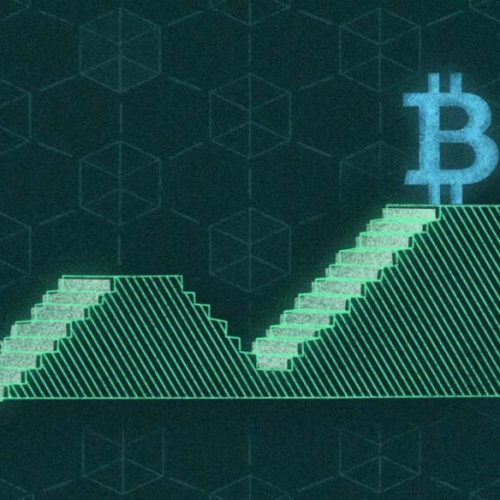

In the past, generally, whenever bitcoin broke through a previous all time high, it was followed by a 100% rally within approximately sixty days. This has happened six times in history: March 2013 it broke $30 to $260 within 60 days; November 2013 broke $260 to $1,200. In May 2017, it broke $1,200 to $3,000; September 2017 broke $3,000 went to $5,000; October 2017 broke $5k and went to $20k; and December 2020 broke $20k and went to $60k within sixty days. Ever since bitcoin’s inception, it has been a rare and exceptionally profitable opportunity to buy breakouts.

There have been three major macro-tops in bitcoin’s twelve-year life span; the $32 top in June 2011, the $1,200 top in December 2013, and the $20,000 top in December 2017. Following each of those macro tops, was an extended bear market varying in length from one to three years. It is important to note that the drawdown has decreased each cycle over time. For instance, in 2011, we had a 93% crash from $32 (6/8/11) to 2$ (11/18/11). Meanwhile, bitcoin experienced a 86% crash from $1180 (11/30/13) to $180 (1/14/14). And finally, it crashed 84% from $20k (12/17/17) to $3100 (12/16/18). The trend indicates that each bear market has grown in length of time, while the drawdowns have slightly decreased over time. Another notable trend from previous cycles is that we tend to explode sometime around Q4 (for the most part).

Compared to previous cycles, currently there seems to be less negative fundamental reasoning nor regulatory warning signals regarding bitcoin, if anything it’s “brand” has grown stronger with time. An example of this is the recent explosion and approval of bitcoin ETFs, which in the past, crypto natives viewed as the holy grail of mainstream adoption. The future always has been, and will continue to be, highly unpredictable. However, that doesn’t mean one should discount the similarities of previous bitcoin cycles and that there might be some merit to them.